Western countries support individual companies constantly.

Intel received $8.5 billion in funding under the CHIPS Act

The General Motors bailout forced the US government to write off a $11.2 billion loss

Shell, ExxonMobil, and others have received countless billions in O&G subsidies

Government sales make up $49.2 billion, or 74.6% of Lockheed Martin’s total sales

The entire principle of US industrial policy is that the government does nothing and everything should be outsourced to a private contractor. Inherently that must mean supporting some private companies more than others.

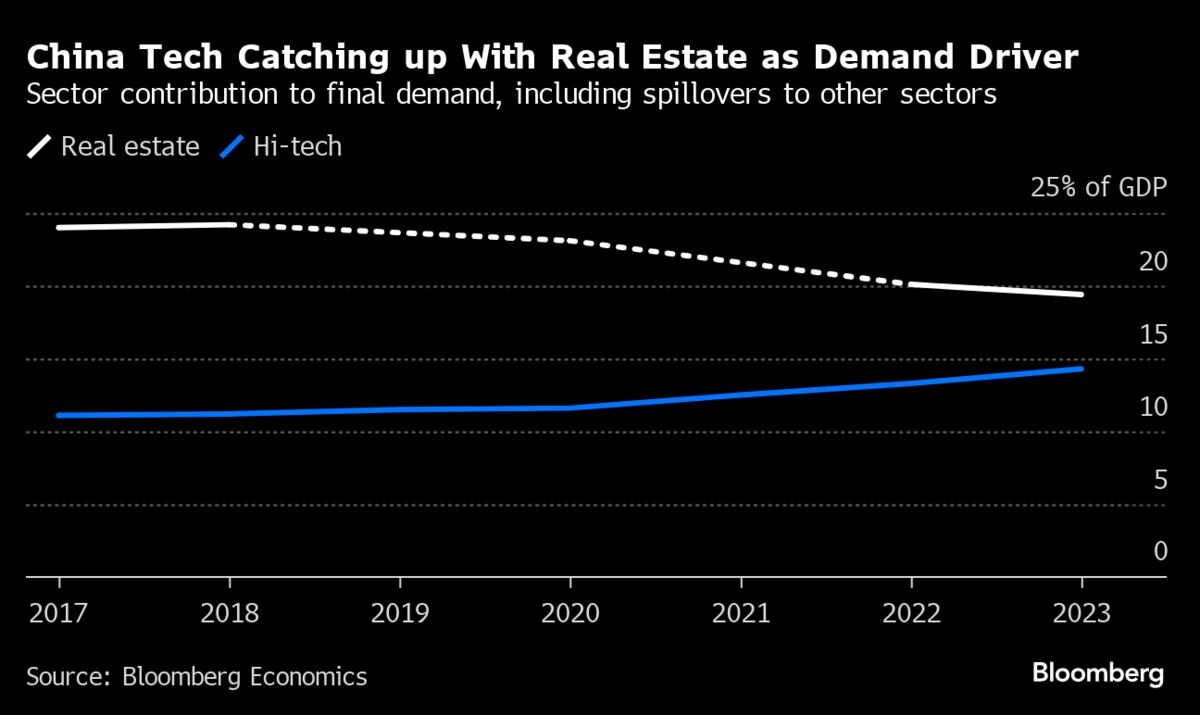

Your argument makes literally no sense when considering that Chinese companies consistently and notoriously sell their products in China for a fraction of the cost of the export models. BYD’s Atto 3 sells for $20k in China and more than $40k in the EU, for example. Those export prices aren’t subsidized. In fact, their margins are absolutely absurd.

The fact is that China has figured out industrial manufacturing and can build the same class of product for half the price… Or less. Of course, there’s no reason to pass those savings onto consumers without competition, and export markets are simply less competitive than China.

The CHIPS Act was signed in 2022.

In 2022, what were the top bleeding-edge node semiconductor fabs? TSMC (Taiwan), Samsung (South Korea), and Intel (USA). Do you see China on that list?

In 2022, what was the only company with a functioning 28nm DUV lithography machine? ASML (Netherlands).

US sanctions – and US sanctions alone – pushed Chinese investment into semiconductors. If you actually worked in the industry, you’d know that the Chinese government has tried for more than a decade to get Chinese companies to use Chinese semiconductor tech… To no avail. The US stabbed itself in the foot, pushed Chinese private capital into Chinese semiconductor firms (instead of foreign ones), and the rest is history. This is basic capitalist theory.

I guess you can also ignore the $15 billion bailout for airlines?

But sure, let’s talk about the great backlash to the GM bailout… ignoring the Chrysler bailout. Ignoring the bailouts of JP Morgan Chase, Bank of America, Citigroup, Morgan Stanley, Wells Fargo, Goldman Sachs… All essential for national security, or so I’m told.

Let’s now talk about companies in China’s EV race… WM Motor, which used to outsell Tesla, is gone. Byton, gone. Aiway, gone. Levdeo, gone. Mitsubishi, gone. Honda, Hyundai, and Ford? All desperate to cut out their JVs.